Does the taxation of goodwill follow accounting concepts? How do you value goodwill for tax purposes?

Taxation of Goodwill

Michael Walpole is a tax professor at UNSW. And the Head of School of the UNSW School of Taxation and Business Law. In this episode he gives a short overview of the taxation of goodwill.

To listen while you drive, walk or work, just access the episode through a podcast app on your mobile phone.

The definition of goodwill is up for discussion at the moment. The pending court case at the High Court against Placer Dome and Barrick Goldmine sees to that. At stake is $54 to 56m of stamp duty plus interest.

Placer Dome

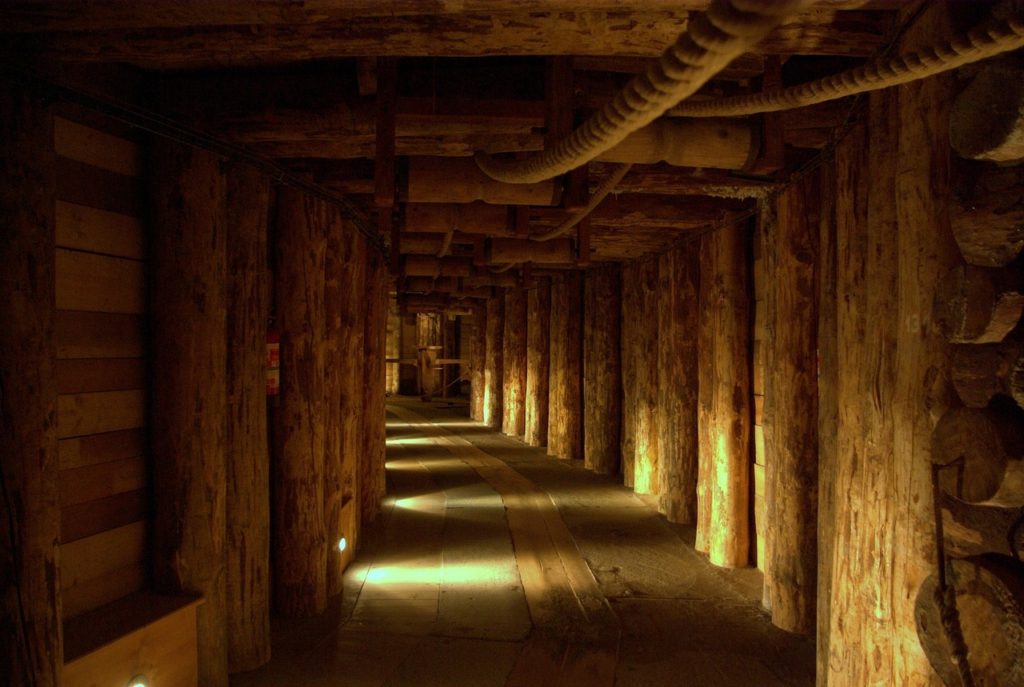

Placer Dome was a large gold miner with a gold mine in Western Australia and over 100 years’ experience in operating goldmines.

In fact in 2005, Placer Dome was the fifth largest gold mining company assessed by market capitalisation. Based on gold reserves it was the third largest. And the fourth largest assessed by gold production. So it clearly was a major player in the gold mining world.

Placer Dome had over 13,000 staff with a management structure and operations and exploration projects in various countries on various continents around the world.

Barrick Gold

In 2006 Barrick Gold took over Placer Dome and became one of the largest gold miners in the world.

Stamp Duty

The Commissioner argued that Placer Dome was a landholder and hence assessed Barrick Gold for stamp duty of over $54, 56 million dollars.

The stamp duty rules in 2006 in Western Australia provided that a corporation was a land-holder and the purchase of its shares therefore subject to so-called ‘land rich’ stamp duty if the corporation owned land in Western Australia worth $1 million or more; and that wasn’t in dispute. Everybody agreed on that one.

But also if the value of land was 60% or more of the value of all property excluding certain ‘liquid’ assets, so all property of Placer Dome. And that was the point in dispute.

Goodwill

The Commissioner argued that Placer Dome just owned land as in gold mine land, nothing else.

And Barrick Gold and Placer Dome argued that this was not the case. That Placer Dome included goodwill. And that the value of land was hence less than the 60% threshold. They pointed to Placer Dome’s extensive operations as proof that the company clearly wasn’t just a whole in the ground.

So the issue is whether Placer Dome had any materially significant goodwill that should be valued separately from the land held by Placer Dome and hence whether Placer Dome was a ‘land-holder’ corporation at the time of the takeover.

After an objection to the assessment had been disallowed, Barrick Gold as the appellant applied to the State Administrative Tribunal which also decided against Barrick Gold.

The evidence in the case showed that So it clearly wasn’t just a piece of land.

Placer Dome put the main finding of the Murray Case into question. Nobody is disputing that goodwill is inherently connected with the business. The Placer Dome case will be about how to value this goodwill.

Initially the Appeals Tribunal upheld the Commissioner’s view that a goldmine has no goodwill. A gold mine is a generic commodity.

However, in the Court of Appeal of the Supreme Court of Western Australia in Placer Dome Inc (Placer) v Commissioner of State Revenue (Commissioner) [2017] WASCA 165 the court decided in favour of the appellant (Placer Dome Inc). It found that some valuations by the Commissioner were wrong and that the company actually did have goodwill. But the case has gone on appeal now.

Once the High Court has issues its ruling, we will talk about this case again.

MORE

Register as a Tax Practitioner

Events Based Reporting Turnaround

Disclaimer: Tax Talks does not provide financial or tax advice. This applies to these show notes as well as the actual podcast interview. All information on Tax Talks is provided for entertainment purposes only and might no longer be up to date or correct. You should seek professional accredited tax and financial advice when considering whether the information is suitable to your or your client’s circumstances.