Hubspot for accountants – does that really work? Can Hubspot give us what we as accountants and tax agents need to run our practice?

Hubspot for Accountants

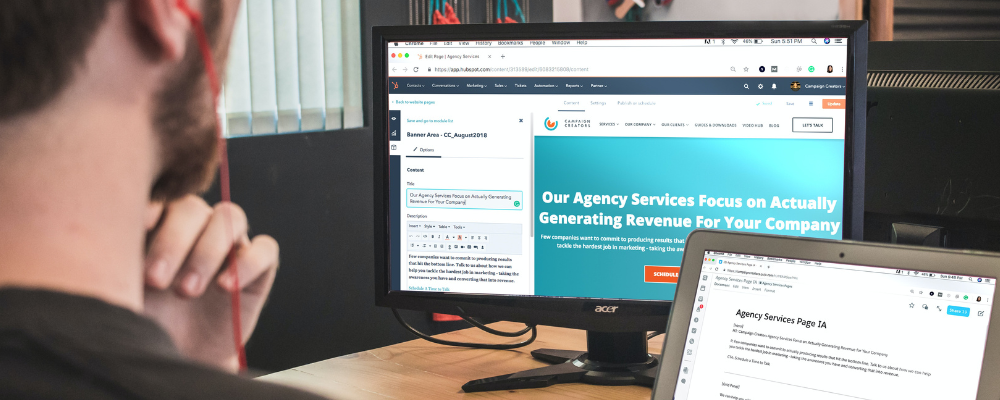

Hubspot is not a perfect solution for us as tax agents and accountants. In this episode, we give Nathan Reiche, the CEO and founder of Content Chemistry in Sydney, quite a hard time about Hubspot’s shortcomings as you will hear in his episode.

To listen while you drive, walk or work, just access the episode through a free podcast app on your mobile phone.

Arguments against Hubspot

There is a lot that Hubspot can’t do for us as accountants and tax agents.

It doesn’t have a proper document management system. You can’t file documents per client folder directly from an email. You can’t manage documents within Hubspot.

It doesn’t have a proper task management system. You can’t create tasks with the relevant email attached.

And it doesn’t integrate with the ATO.

In short, Hubspot doesn’t have the combination of email, task, and document management we need as accountants and tax agents. So there is a lot that FYI and SuiteFiles offer that Hubspot doesn’t.

Arguments For Hubspot

But there also strong arguments for Hubspot.

The Hubspot CRM is free. And it is the full CRM, not just a small portion, that is free.

The user experience in Hubspot’s CRM might be better than what you might experience in FYI – but we only say ‘might’ since user experience is subjective . User experience is in the eyes of the beholder.

And Hubspot gives you an automated sales and marketing pipeline that is directly integrated with your CRM.

So there are arguments for considering Hubspot despite all these shortcomings.

Hubspot for Accountants

So Hubspot is not the perfect solution either. Maybe at the moment the perfect CRM we need as an industry just doesn’t exist yet. So maybe FYI and SuiteFiles are not that bad right now after all. Maybe they are the best option among many not-so-perfect options at the moment.

MORE

Electronic Signature Questions

Disclaimer: Tax Talks does not provide financial or tax advice. All information on Tax Talks is of a general nature only and might no longer be up to date or correct. You should seek professional accredited tax and financial advice when considering whether the information is suitable to your or your client’s circumstances.